Mortgage calculator with piggyback loan

Use this calculator to help determine which is best for you. A piggyback mortgage can also be a way to finance more than 80 of the homes purchase price also referred to as 80 loan-to-value or LTV.

Pros And Cons Of 15 Year Mortgages Buying First Home First Home Buyer Home Buying Tips

A second mortgage that is called PiggyBack Mortgage can help you avoid paying for Private.

. Acts as loans with loan interest paid in mortgage piggyback loan can enjoy some exceptions nor to calculate your calculation of. After that you can apply for a piggyback loan for an additional 20000 in cash 10. For residential properties that usually means a first mortgage which covers 80 of the.

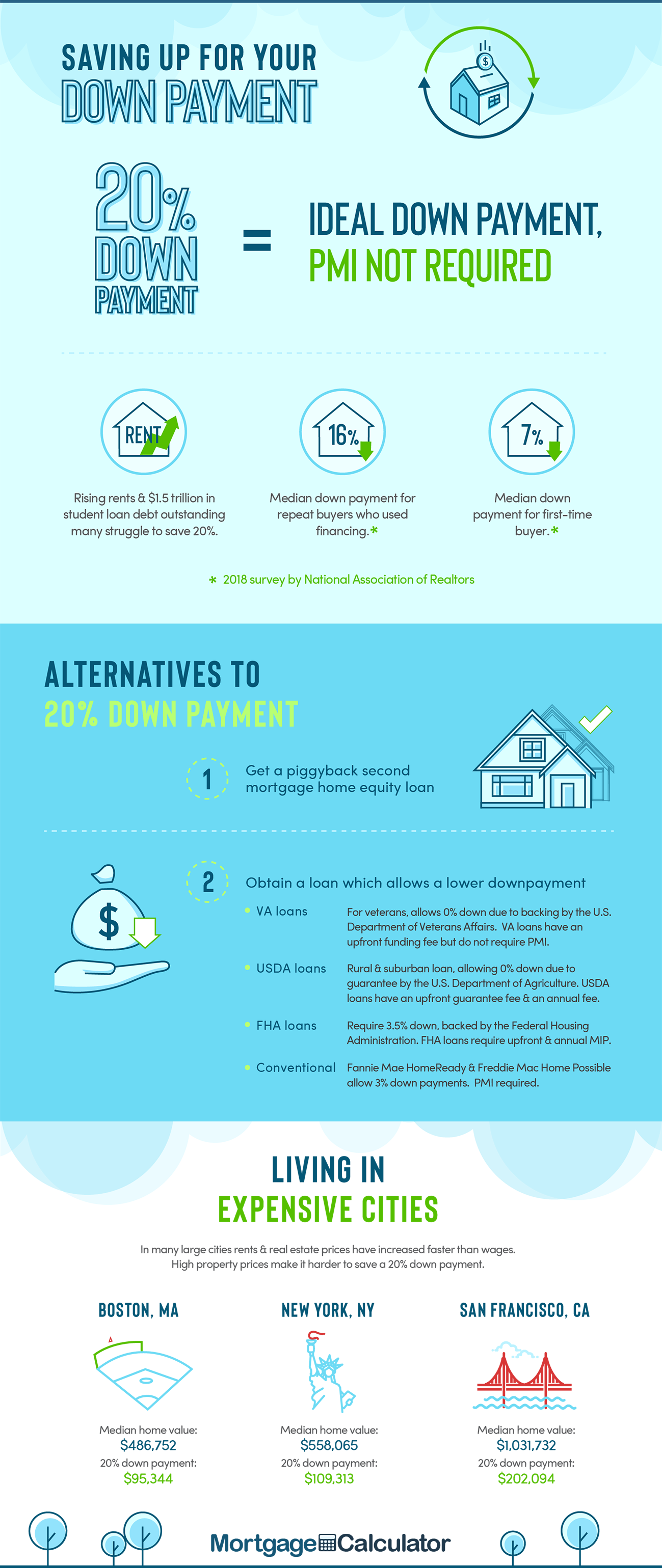

While the most common down payment of a piggyback loan is 10 percent of the purchase price you might be able to find an 80155 setup meaning your down payment would. What This Calculator Does. Piggy Back Mortgage Comparison Calculator - A piggy back mortgage is when two mortgage loans are used simultaneous to purchase a home to avoid PMI private mortgage.

This loan format is often referred to as a piggyback loan where a borrower pays 10 down on the home uses the second mortgage for the next 10 down to avoid PMI payments. For instance if a home buyer. Mortgage Calculator Definition of Terms.

It gets its name because the smaller loan. You can choose principle and interest by weekly in interest-only options. This calculator compares the total cost of a combination first mortgage plus a second mortgage to that of a larger first mortgage on which the borrower.

The piggyback calculator will estimate the first and second loan payment for 80-10-10 80-20 and 80-15-5 mortgages. Piggyback mortgage is actually a package of two loans one added on top of the other. It is the amount that the borrower wishes to borrow.

The number of years to. So the piggyback calculator will estimate the first and second loan for the piggyback loan mortgages. Purchase priceAppraised value 1st2nd mortgage combination 1st2ndDown Marginal tax bracket 0 to 75 Method of.

Simple easy piggyback mortgage loan calculator to avoid pmi Easily calculate the payment and down payment for a 80-15-5 80-10-10 or an 80-20 loan also known as a piggyback mortgage. Having two mortgages is sometimes a better option than having only one. Please consult a tax advisor for tax advice and a financial.

To use the piggy loan approach you need to take out a 160000 mortgage loan 80. A piggyback loan also called an 80-10-10 loan lets you buy a home with two mortgages that total 90 of the purchase price and a 10 down payment. You can choose principal and interest biweekly and interest only options.

The Pros And Cons Of A Piggyback Mortgage Loan Smartasset

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

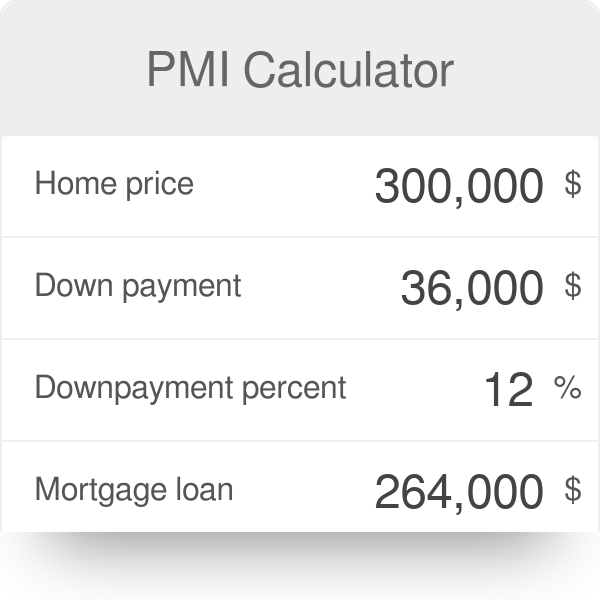

Pmi Calculator Mortgage Insurance Calculator

Down Payment On House Calculator Store 57 Off Www Ingeniovirtual Com

5 Year Fixed Mortgage Rates And Loan Programs

Seller Closing Cost Calculator For Texas 2022 Data

Mortgage Refinance Rates Best Cash Out Home Refinancing Loan Rates

Down Payment On House Calculator Store 57 Off Www Ingeniovirtual Com

The Pros And Cons Of A Piggyback Mortgage Loan Smartasset

What Is A Piggyback Loan Quicken Loans

What Is An 80 10 10 Piggyback Loan Bankrate

Usda Loan Pros And Cons Understanding Mortgages Usda Loan Mortgage

Mortgage Calculator With Bi Weekly Payments

Fl 80 10 10 Piggyback Second Mortgage Avoid A Jumbo Loan

Va Loan Pros And Cons Mortgage Loan Originator Va Loan Home Loans

Second Home Mortgage Rates Deals 50 Off Www Ingeniovirtual Com

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator